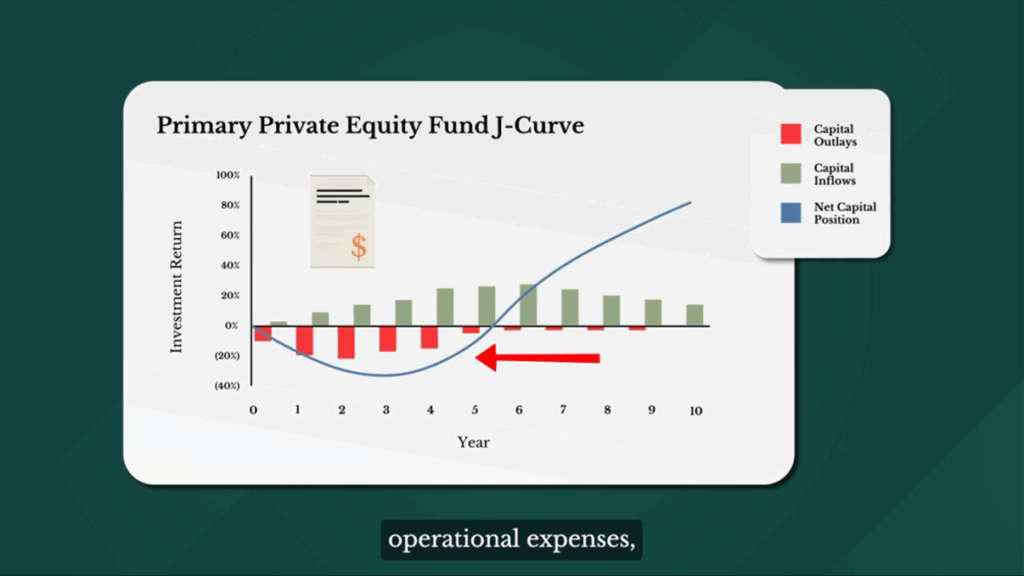

arket funds, where the capital drawdowns and distributions follow the shape of the letter ‘J’.

00:00:13 – 00:00:28

In the early years of a fund, you’ll often see negative performance, represented by the curved part of the J. This happens because capital is being deployed to cover fees, operational expenses, and to make new investments.

00:00:29 – 00:00:41

As the fund progresses and investments have time to grow, returns often rise above the initial costs. This turning point is shown by the upward curve of the J, where the fund starts generating positive gains.

00:00:41 – 00:00:58

To summarize, a typical primary private equity fund sees cash outflows in its early years, often called the Investment Period, with more growth and cash distributions occurring in the middle to later years of the fund’s life, also known as the Realization period.

00:00:58 – 00:01:08

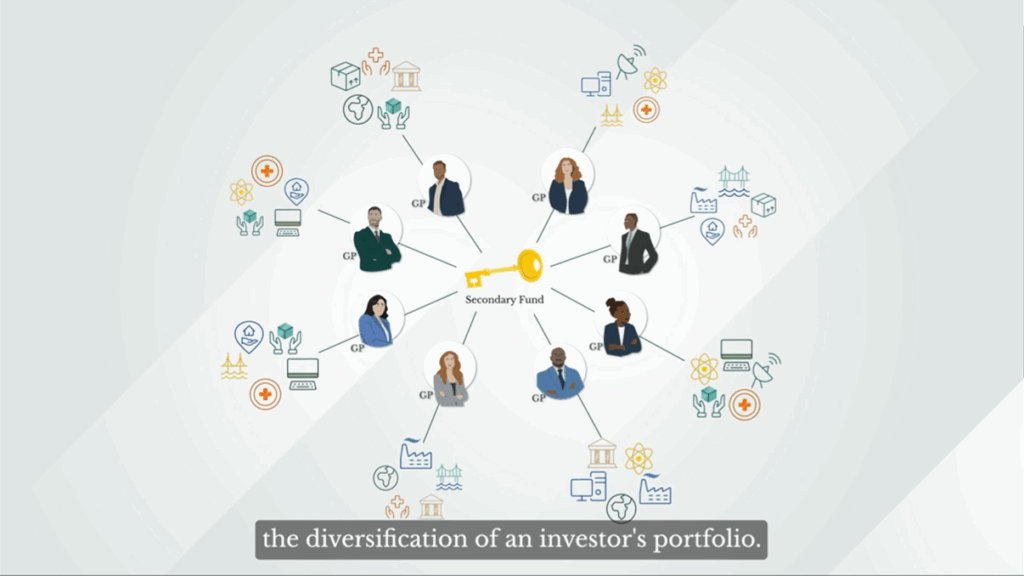

The beauty of secondary funds is they typically purchase private equity investments that have already passed through the downward part of the J-Curve and are well into the realization period.

00:01:09 – 00:01:20

Because of this strategic entry point, secondaries investors typically receive distributions sooner, leading to a quicker return of their initial investment compared to primary fund investors.

00:01:21 – 00:01:33

By reducing the exposure to the downslope of the J-curve and participating in the upslope, secondaries have historically provided more stable, risk-adjusted returns, making them a reliable option in private market investing.

00:01:35 – 00:01:45

Investing in private markets is complex and is not without risk, so partnering with a seasoned manager with a strong track record in navigating market challenges is essential.