Why secondaries for private wealth investors?

Private markets are playing an increasingly critical role in modern portfolios, and secondaries are at the centre of this evolution. As individual investors seek diversification, return potential, and resilience beyond the traditional 60/40 model, financial advisors must be equipped to guide them through the growing array of opportunities.

That’s why we created the Secondaries Institute – to help advisors lead the conversation, better serve their clients, and unlock new opportunities in the private markets.

Understanding secondaries – how they work, where they fit, and why they matter – is essential for building long-term success in this space. At Coller Capital, we’ve spent decades at the forefront of secondaries. Now we’re putting that experience to work for you, because better outcomes start with better understanding.

Jake Elmhirst

Partner and Head of Private Wealth Secondaries Solutions

Watch

Access concise, informative videos that bring the concepts of secondaries investing to life.

Introduction to private equity secondaries

Discover how secondaries unlock liquidity, diversification, and value in private equity investing.

Accessing the secondaries market

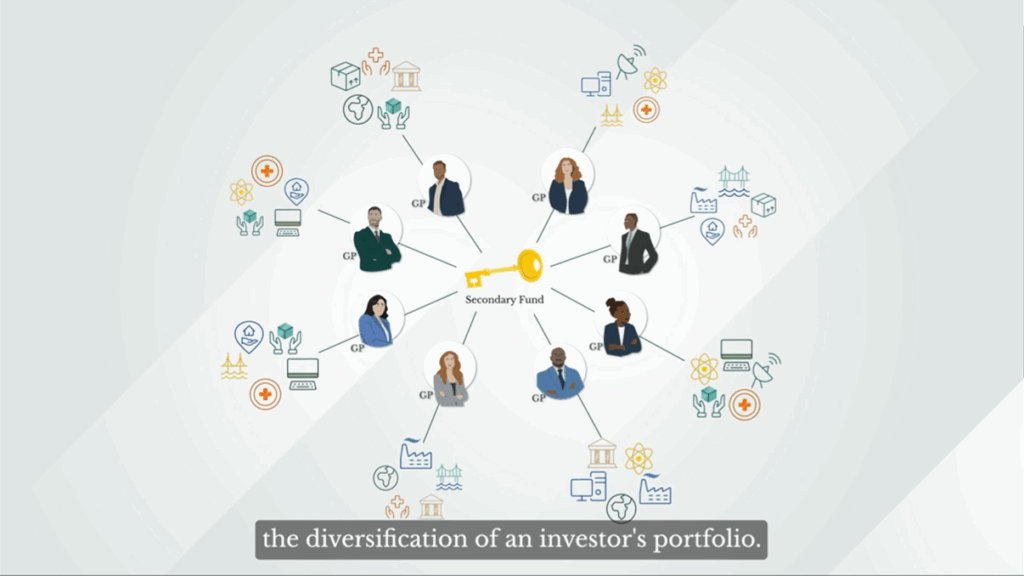

The diversification power of secondaries

See why secondaries are a smart solution for efficient, long-term private market diversification.

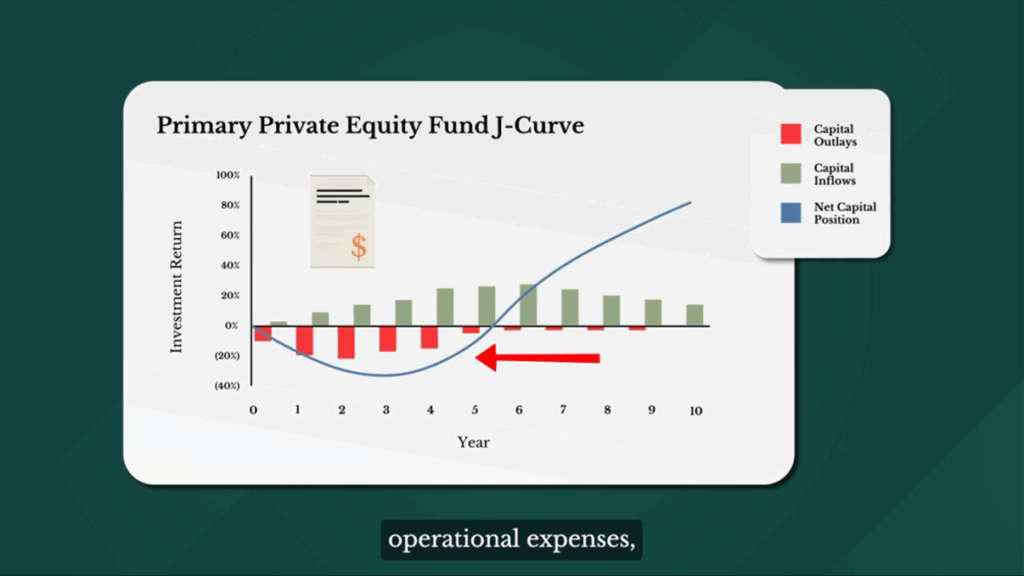

Mitigating the J-Curve through secondaries investing

Reducing blind pool risk

Discover how secondaries investing helps reduce blind pool risk by providing transparency into underlying assets and leading to potentially better risk-adjusted returns.

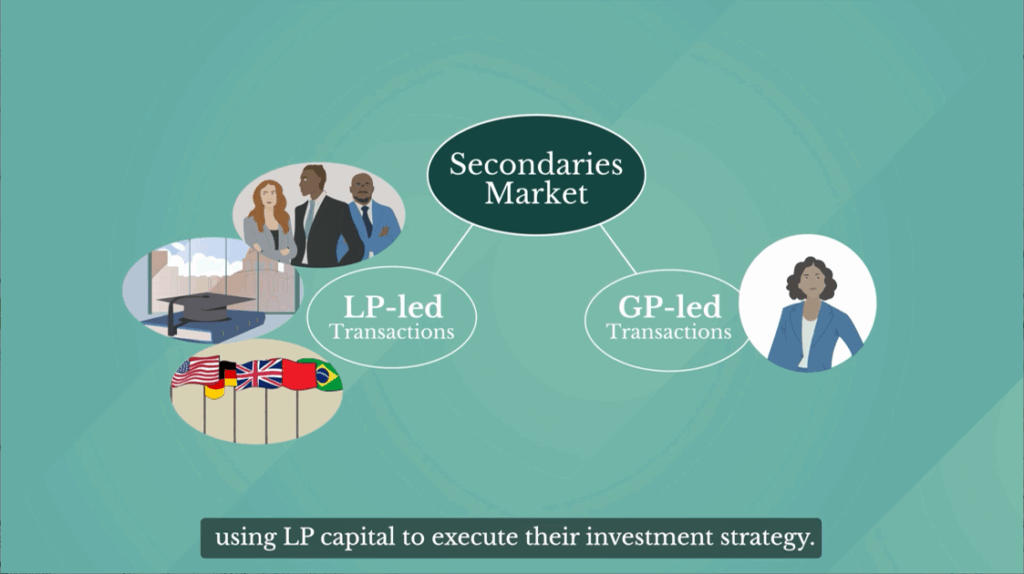

LP-Led and GP-Led transactions

Learn the difference between LP-led and GP-led secondary transactions, and how each type creates unique opportunities for investors seeking private market exposure.

Introduction to private credit secondaries

Explore how private credit secondaries work, why they’re gaining traction, and how they help investors manage risk and enhance portfolio diversification.

Read

Access expert-written content, designed to educate and inform on all aspects of secondaries investing.