ate equity, but they play an equally vital and growing role in private credit.

00:00:14 – 00:00:20

So, what exactly is private credit, and how does it work? Let’s take a closer look.

00:00:21 – 00:00:34

Private credit, also known as private debt, refers to loans and other forms of debt financing provided by non-bank institutions, such as alternative asset managers, private equity firms, and specialized lenders.

00:00:35 – 00:00:48

Unlike public debt, these loans are not bought and sold on an exchange. Instead, they’re negotiated directly with private businesses, often offering higher yields and lower volatility in exchange for reduced liquidity.

00:00:49 – 00:01:10

A popular way for investors, or LPs, to access private credit is through closed-end funds, which typically invest over a seven-to-ten-year period. Capital is deployed into loans, and returns are generated through interest payments from borrowers. As loans are repaid over time, the fund returns capital to investors through regular cash distributions.

00:01:11 – 00:01:32

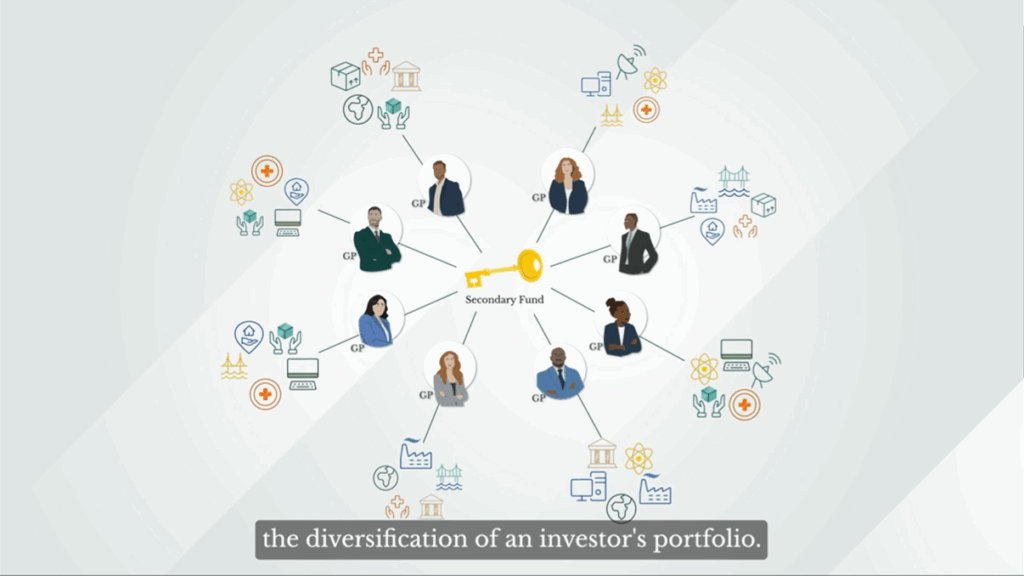

Should an investor in a primary private credit fund wish to sell their stake before the natural life of the fund comes to an end, they can sell their position in the secondaries market to a buyer like Coller Capital. This provides the LP with the flexibility to rebalance their portfolio, access liquidity, or manage risk according to their investment needs.

00:01:33 – 00:01:47

For buyers, it offers access to a seasoned loan portfolio already generating income, while significantly reducing blind pool risk, and because these assets are typically acquired at a discount, there’s real potential for enhanced returns.

00:01:48 – 00:02:05

In short, private credit secondaries provide a smart, flexible way to manage risk, enhance income, and strengthen portfolio resilience. That’s why working with an experienced secondaries manager isn’t just smart, it’s essential.