tly stood out, secondaries. Over the past two decades, secondaries have delivered some of the strongest median net returns with lower volatility than many other private market strategies.

00:00:20 – 00:00:44

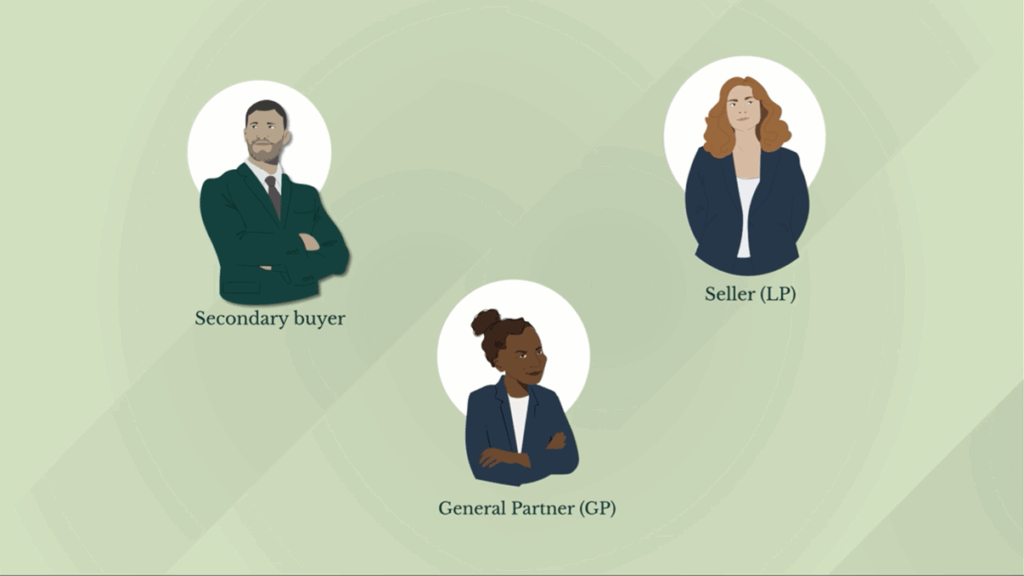

But until recently, investing in secondaries was primarily reserved for only the largest and most sophisticated institutional investors, such as pensions, endowments, and sovereign wealth funds. Now, access is expanding, opening the door for high-net-worth individuals to benefit from this unique asset class. So, how can high-net-worth individuals participate?

00:00:45 – 00:01:10

The first option is through financial advisory relationships with investment banks, enabling investment alongside institutional investors in a closed-end secondaries fund, often referred to as a drawdown fund. Drawdown funds have a typical lifespan of ten plus years and require investors to commit capital upfront. The fund manager then calls on that capital only as investment opportunities arise.

00:01:11 – 00:01:24

In many cases, it can take several years for a commitment to be fully invested. Returns in drawdown funds typically start flowing back to investors after a few years once investments are sold.

00:01:24 – 00:01:57

Another increasingly popular option is semi-liquid products, also known as evergreen funds. These products allow investors to buy into a diversified portfolio of secondary investments, typically at significantly lower investment minimums. These funds typically offer periodic liquidity options for investors, such as quarterly or semi-annual redemptions. Unlike drawdown funds, an investor’s entire capital commitment is put to work immediately, enabling them to receive returns on their investments sooner.

00:01:58 – 00:02:13

Both drawdown and evergreen funds offer unique advantages and considerations. Choosing the right access point depends on your investment goals, risk tolerance, and liquidity needs. What’s clear is that secondaries are now more accessible than ever.

00:02:13 – 00:02:31

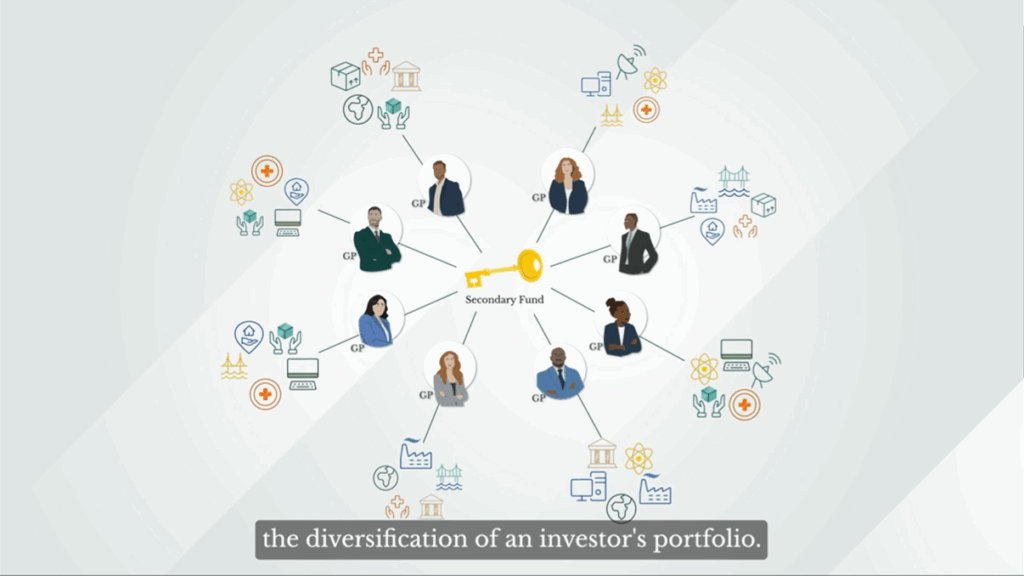

While private market investing can be complex and carries risk, it also offers compelling risk adjusted returns and can play a valuable role in building a well-diversified portfolio. Selecting an experienced manager with a proven ability to navigate the unique market dynamics of secondaries investing is crucial.