How secondaries capitalise on private market constraints

Private market strategies, such as private equity and private credit, have long been known for their potential to deliver attractive returns, in part due to the illiquidity premium. Investors are typically rewarded with higher returns for tying up their capital over longer periods compared to public markets. But while this illiquidity can be beneficial in the long term, it also presents real-world challenges, particularly when market conditions change or investors’ liquidity needs evolve.

This is where the secondaries market comes in. Secondaries investing turns a challenge – illiquidity – into an opportunity, offering solutions for sellers and potential value for buyers.

Why illiquidity exists in the private markets

When investors commit capital to a primary private market fund – say, a 10-year private equity or private credit vehicle -they generally can’t redeem or exit their investment on demand. These funds operate on long-term time horizons, investing capital gradually and returning proceeds over several years. This structure helps managers stay focused on long-term value creation but means that investors are often “locked in.”

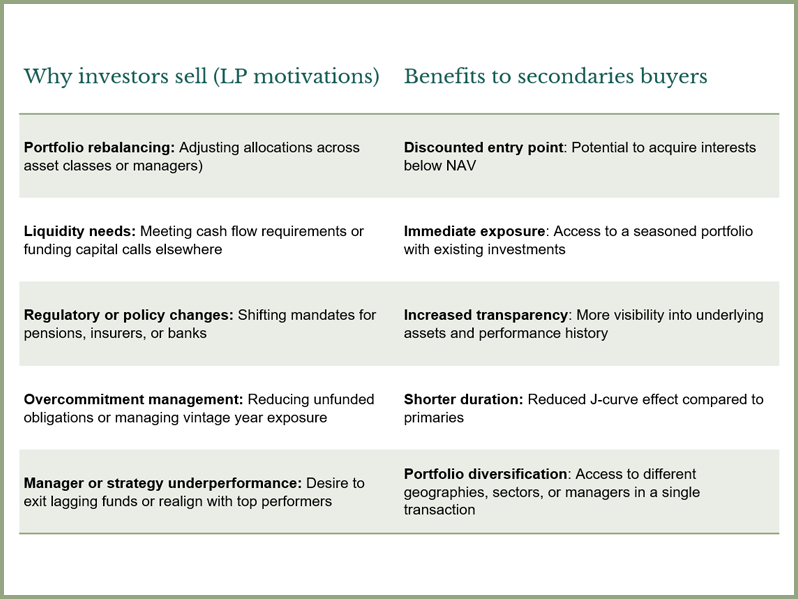

In a stable environment, this arrangement works well. But life, and markets, don’t always cooperate. Investors may need to rebalance portfolios, respond to unexpected cash needs, or reduce exposure to certain asset classes. In volatile or uncertain markets, the desire for liquidity can grow even stronger.

The secondaries market: a liquidity solution

Secondaries funds provide a critical solution to this illiquidity challenge. They purchase interests in existing private market funds, often at a discount, from investors seeking an earlier exit. For the selling investor, secondaries offer flexibility and liquidity that the original fund structure doesn’t provide. For the buyer, secondaries create an opportunity to acquire high-quality private market assets – often with greater visibility into the portfolio and at potentially discounted prices.

Secondaries investing can allow investors to access the illiquidity premium with greater efficiency. By buying into funds mid-life, secondaries investors may avoid the early “J-curve” of capital calls and fees, gain earlier distributions, and benefit from increased visibility into the underlying portfolio companies or loans. When transactions are priced attractively, often due to the liquidity needs of the seller, there’s additional potential for strong risk-adjusted returns.

Illiquidity creates opportunity

Periods of market stress or dislocation often lead to a spike in secondary market activity. When more primary investors seek liquidity at the same time, discounts tend to widen and secondaries firms can be more selective, buying interests in high-quality funds or assets at attractive valuations.

In essence, the illiquidity that private markets require to deliver strong returns also creates the very inefficiencies that secondaries firms are built to capture. And in doing so, they provide a valuable service to the entire private market ecosystem – bringing liquidity where it’s otherwise unavailable and generating potential long-term value for new investors.

Conclusion

The secondaries market plays a vital and growing role in today’s private market landscape. It transforms a core challenge – illiquidity – into an opportunity, offering capital solutions to those who need it and creating compelling investment opportunities for those who can take advantage of it.

For financial advisors and individual investors looking to enter private markets more strategically, secondaries may offer a differentiated path, one that combines the strengths of private investing with enhanced flexibility, visibility, and potential value.