Understanding private credit

Private credit refers to non-bank lending – capital extended to companies outside of traditional public or syndicated debt markets. These loans are often customised, directly negotiated between lenders and borrowers, and tailored to meet the specific needs of middle market companies, typically backed by a private equity firm. Rather than trading on public exchanges, private credit is held by institutional and increasingly high-net-worth investors seeking predictable income and capital preservation.

Private credit strategies play a critical role in financing businesses across industries, providing flexible, scalable solutions where traditional banks cannot. With interest rates elevated and lending standards tightening, demand for private credit is accelerating, creating an attractive opportunity for investors.

A rapidly expanding segment of the market

Private credit has evolved from a niche corner of the alternatives universe into one of the most dynamic and fastest-growing segments of the private markets. Global private credit assets under management (AUM) reached approximately $1.7tn at the end of 2024, an extraordinary increase from just $300bn in 2010. And the growth is expected to continue. Forecasts suggest that AUM could surpass $2.6tn by 2029, underscoring the asset class’s expanding role in institutional and individual investor portfolios.

(Source: Preqin, “2025 Global Report: Private Debt,” December 2024).

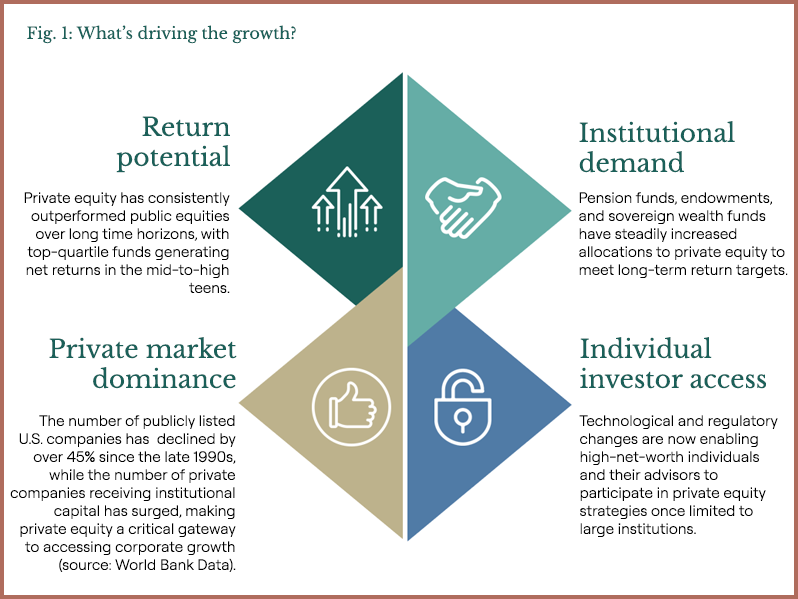

This rapid expansion is being fuelled by strong demand on both sides of the market. Investors are increasingly drawn to private credit for its attractive risk-adjusted returns, income potential, and portfolio diversification benefits, particularly in a world of uncertain interest rates and persistent inflation. At the same time, corporate borrowers, especially those in the middle market, are seeking flexible, tailored financing solutions that traditional banks often can’t or won’t provide.

The result is a powerful and ongoing shift: private credit is no longer just an alternative, it’s becoming a core component of modern portfolios.

Core private credit strategies

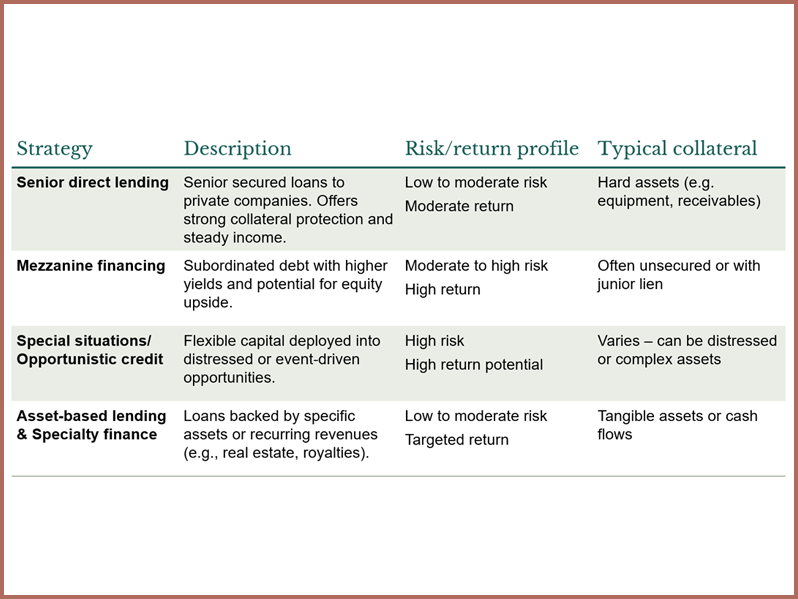

Private credit encompasses a diverse set of strategies designed to meet the financing needs of private companies while offering investors a range of risk and return profiles. These strategies vary based on where they sit in the capital structure, the type of borrower, and the nature of the collateral. The chart below outlines the core private credit strategies and how they differ.

The private credit investment lifecycle

Investing in private credit typically involves a shorter and more stable capital cycle than private equity. Many funds deploy capital over two-to-three years and begin returning interest and principal within months of investment.

Investment phase (Years 0-2)

Fund managers identify and underwrite loans, working closely with borrowers to structure favourable terms and protections. Capital is often deployed quickly, and interest payments begin shortly thereafter.

Harvesting phase (Years 2-6+)

Borrowers make regular interest payments and eventually repay principal through refinancing, recapitalisations, or asset sales. Distributions to investors tend to be consistent, making private credit attractive for income-focused portfolios.

Why private credit?

Private credit’s appeal lies in its balance of yield, capital preservation, and portfolio diversification.

- Consistent cash flow

Regular interest payments provide a natural income stream—often floating-rate and less sensitive to inflation. - Lower volatility

Privately negotiated terms and illiquidity can reduce market price swings compared to public bonds or equities. - Capital structure protection

Senior secured loans often sit at the top of the capital stack, with meaningful downside protection through covenants and collateral. - A history of attractive returns

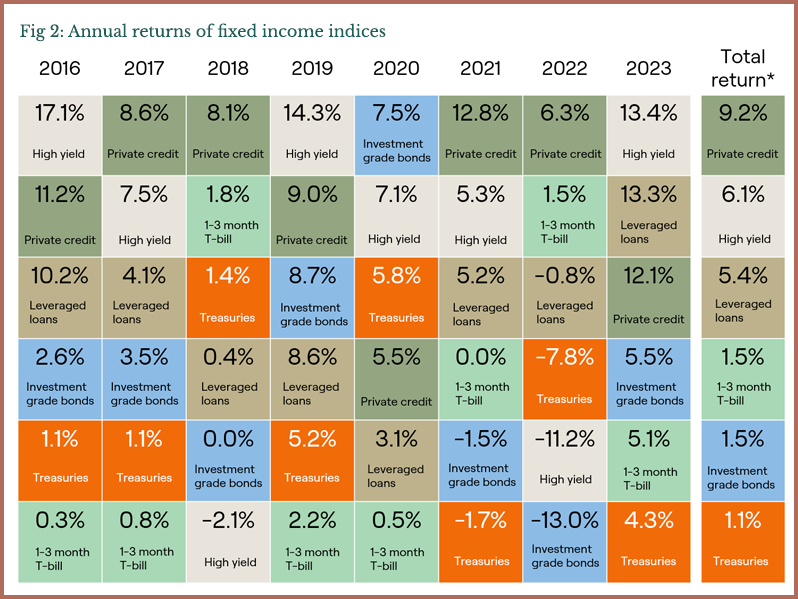

Private credit has performed favourably when compared to public market equivalents (see Figure 2).

The rise of private credit secondaries

Private credit secondaries involve the purchase and sale of existing positions in private credit funds or loans. Like their private equity counterparts, secondary transactions allow investors to step into seasoned portfolios – often at a discount – shortening the time to income and reducing blind pool risk.

Market momentum

As private credit continues to gain traction among institutional and individual investors, so too does interest in its secondary market. While still in the early stages compared to the more mature private equity secondaries space, private credit secondaries have emerged as a powerful tool for enhancing portfolio liquidity, managing risk, and accessing seasoned credit assets.

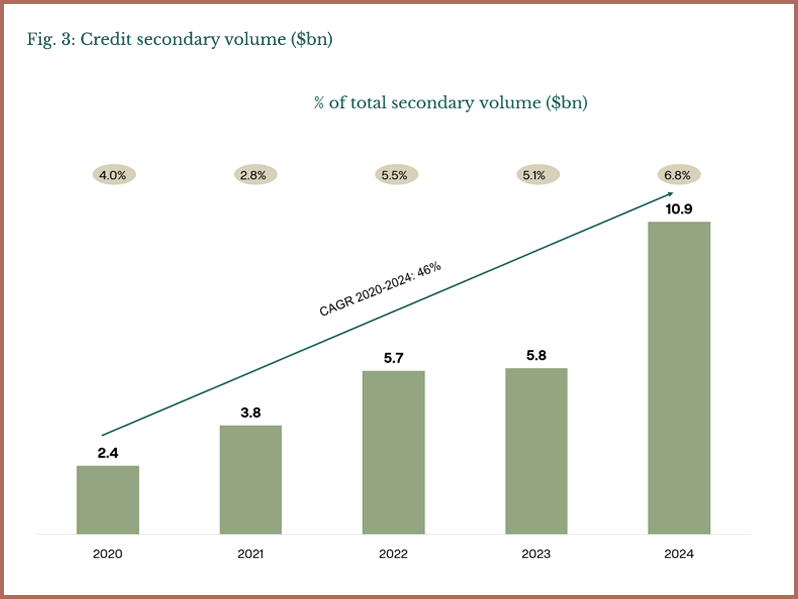

Driven by increased adoption of private credit strategies, evolving market infrastructure, and growing demand for flexible capital solutions, the private credit secondaries market is scaling quickly.

In 2024, transaction volume reached nearly $11bn (see Figure 3), up from less than $3bn in 2020. Institutional allocators and private wealth investors alike are increasing their exposure – drawn by the ability to invest in diversified, income-generating credit portfolios at potentially attractive valuations

Why are private credit secondaries growing?

- Expanding primary market

More private credit funds are being raised and deployed, creating a larger pool of potential secondary transactions. - Liquidity needs of LPs

Investors are increasingly rebalancing portfolios and seeking earlier exits from illiquid strategies. - Strategic portfolio management

Secondaries provide tools for investors to manage fund exposure, duration, and manager diversification. - Efficient access for new entrants

Private wealth platforms use credit secondaries to offer diversified, income-generating exposure with more transparency and immediacy.

Common transaction structures

- LP-led transactions

A limited partner sells their interest in a credit fund to a new buyer, who assumes the position and begins receiving future interest and principal distributions. - GP-led transactions

A fund manager offers investors the option to roll their stakes into a continuation vehicle or sell to secondary buyers, often to extend the life of high-performing loans or portfolios.

Investment characteristics

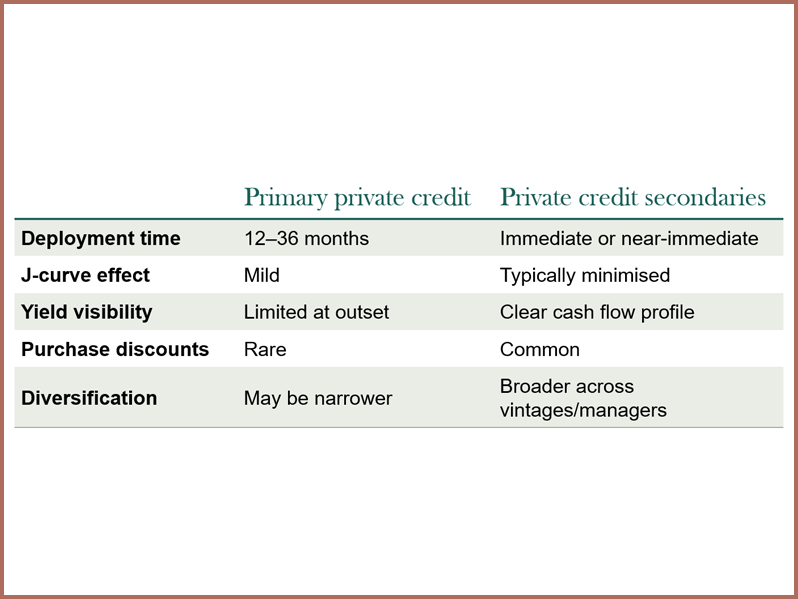

Private credit secondaries offer a distinct profile compared to traditional primary allocations.

A compelling addition to private portfolios

Private credit secondaries are emerging as a powerful tool for financial advisors and investors seeking:

- Faster access to attractive yield, typically significantly higher than public market equivalents;

- Exposure to diversified, seasoned portfolios;

- Greater visibility into risk and performance; and

- The ability to mitigate blind pool risk.

As private credit matures into a core portfolio allocation, secondaries offer a smart and efficient way to participate, helping investors capitalise on both stability and upside in private markets.