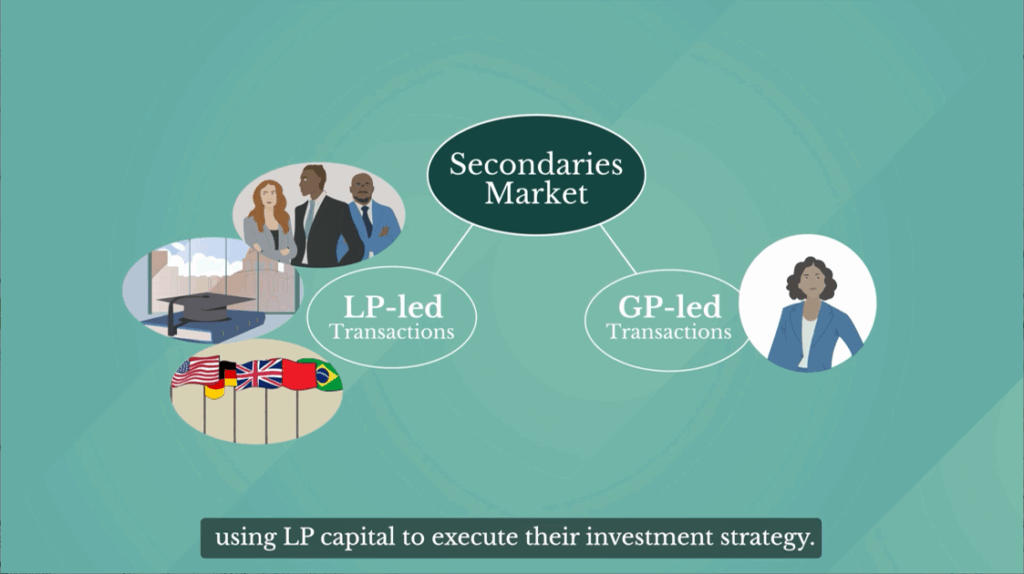

istinguished by who initiates the transaction.

00:00:11 – 00:00:26

First, let’s define the roles. Limited partners, or LP’s, are investors in private funds. Common examples of LP’s include endowments, sovereign wealth funds, and high net worth individuals.

00:00:27 – 00:00:43

General partners, or GPS, manage those funds using LP capital to execute their investment strategy. Typically, LPs commit capital to a fund for up to 10 years. If they need to access their investment capital early, they can sell it on the secondary market to a buyer.

00:00:44 – 00:00:54

Like collar capital, they may choose to sell the investment in a single fund or a portfolio of multiple fund positions with many underlying assets.

00:00:55 – 00:01:06

LP LED transactions have become increasingly common as sophisticated investors leverage secondaries funds to take a more active approach in managing their private market portfolios.

00:01:07 – 00:01:18

As a result, annual LP LED transaction volumes have grown significantly, reaching approximately $83 billion, more than double what they were a decade ago.

00:01:19 – 00:01:34

In contrast, GP LED transactions are initiated by the GP. There are several reasons a manager might do this, but it’s often motivated by the GPS interest in retaining exposure to high performing assets with significant remaining upside.

00:01:1:35 – 00:01:47

In this example, the GP moves the asset into a new investment vehicle known as a continuation fund, which typically involves A secondary’s manager like Collar Capital to help structure and lead the transaction.

00:01:1:48 – 00:01:57

At this moment, investors in the primary fund have a choice. They can choose to redeem their existing investment or roll it over to the continuation fund.

00:01:1:58 – 00:02:09

GP LED transactions have also grown increasingly popular, now making up nearly 50% of all secondary transactions, up from less than 5% a decade ago.

00:02:10 – 00:02:21

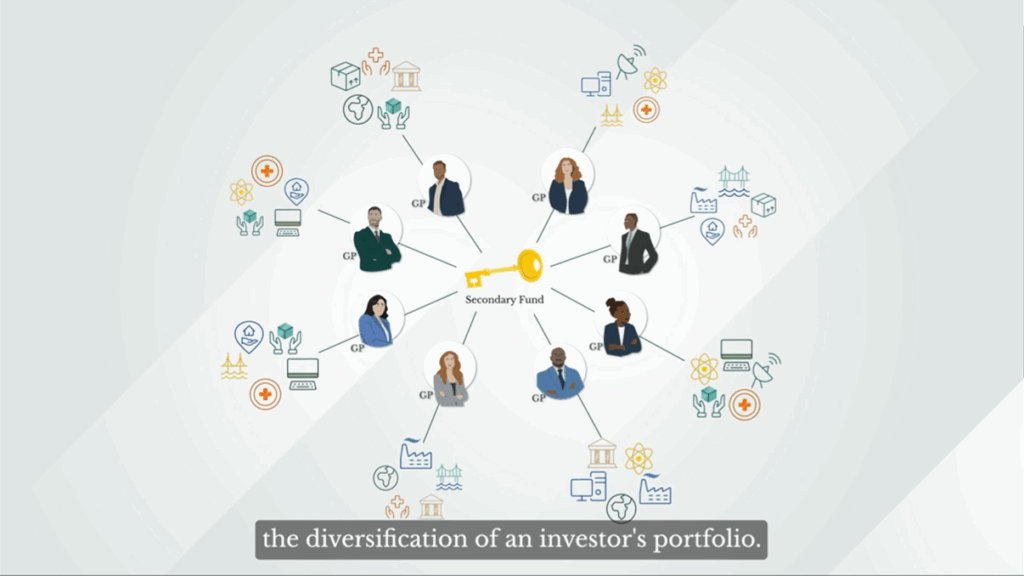

For secondaries investors, LP LED portfolios offer diversification and stable cash flows, while GP LED transactions provide concentrated exposure to high quality assets managed by experienced GPS.

00:02:22 – 00:02:31

A well balanced portfolio with both LP and GP LED deals can give investors diversified access to private assets with an attractive risk return profile.

00:02:32 – 00:02:44

Investors seeking exposure to the secondary’s market should work with experienced managers to find the right mix of LP and GP LED investments that align with their risk tolerance and return goals.