more specifically, the buying and selling of stocks and bonds on well-known exchanges like the New York Stock Exchange, NASDAQ, and other regional exchanges.

00:00:19 – 00:00:27

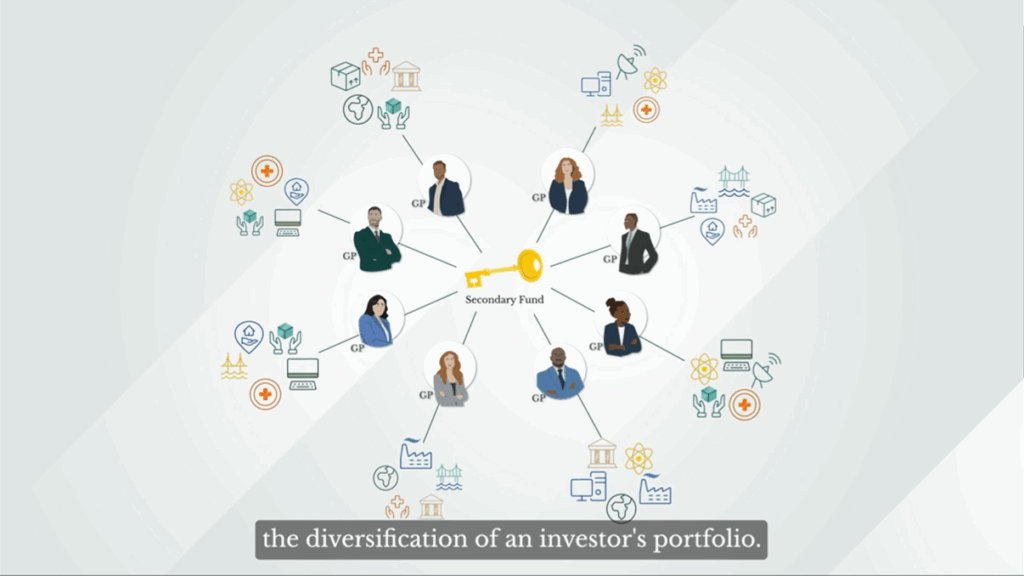

But new opportunities are now opening for some investors, which can be just as crucial for building a well-diversified long-term investment strategy.

00:00:28 – 00:00:31

Introducing private markets.

00:00:32 – 00:00:46

Simply put, private markets involve investments that aren’t traded on public exchanges. Instead, transactions in private markets are negotiated directly between investors and businesses, often facilitated through private funds.

00:00:48 – 00:00:58

Private markets offer a significant opportunity for investors worldwide, as nearly ninety percent of businesses with a hundred million dollars or more in revenue are privately owned.

00:00:59 – 00:01:06

Well-known private market strategies include private equity, private credit, real estate, and infrastructure.

00:01:08 – 00:01:32

Investments in private markets are frequently structured through a limited partnership. In this arrangement, limited partners or LPs provide the capital for investment. Common LPs can include sovereign wealth funds, endowments, and high net worth individuals. These investors pool their resources to create a fund which is managed by a general partner or GP.

00:01:33 – 00:01:51

GPs are the experts who manage that capital, selecting and overseeing the investments to drive returns. The funds they manage typically have a predetermined lifespan of around ten years, during which time the GP will aim to invest the fund, generate returns, and distribute capital back to LPs.

00:01:52 – 00:02:03

Given the extended duration and illiquidity associated with a ten-year commitment, private market investors typically seek returns that exceed those available in more liquid public markets.

00:02:03 – 00:02:13

High quality GPs with the ability to make and exit investments over a longer time horizon, have historically outperformed traditional public equity investments.

00:02:14 – 00:02:23

Investing in private markets can be complex and is not without risk, which is why it’s critically important to partner with an established and reputable general partner.