rchasing existing interests or assets from investors in primary private funds.

00:00:14 – 00:00:32

Over the course of a typical ten-year commitment to a primary private equity fund, investors, known as limited partners or LPs, may need flexibility. Changing financial goals, unexpected cash needs, or the desire to lock in gains can prompt an early exit.

00:00:32 – 00:00:42

That’s where the secondary market steps in, providing a valuable solution for investors to access their investment capital without waiting for the fund’s full term to end.

00:00:43 – 00:01:04

Before the secondary market emerged, investors in primary funds had no way to access liquidity for their investments. However, the growth of the secondary market has dramatically transformed this landscape, with transaction volumes rising from ten billion dollars annually fifteen years ago to over one hundred and sixty billion dollars in recent years.

00:01:04 – 00:01:22

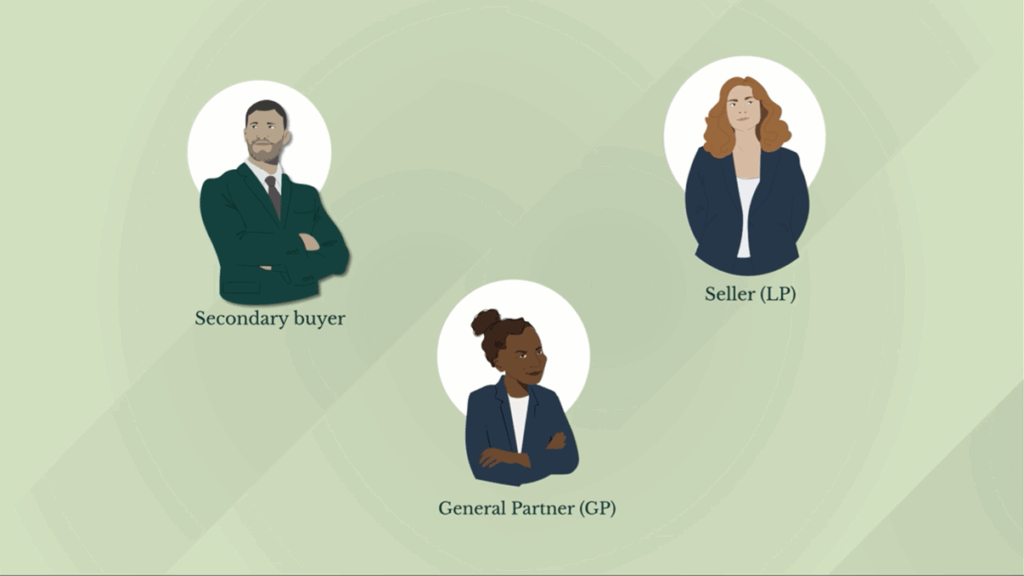

As mentioned, a secondary transaction involves a buyer, like Coller Capital, acquiring an investment that’s initiated, or led, by either an LP or GP. Hence the name ‘LP led’ or ‘GP led’ secondary transaction. Let’s dive into this a bit more.

00:01:22 – 00:01:43

In an LP led transaction, the limited partner initiates the sale of an existing position in one or more primary private equity funds. A secondary buyer, like Coller Capital, can negotiate a purchase price with the limited partner and assume its position in the aforementioned primary funds. It’s a win win scenario for both parties.

00:01:43 – 00:01:54

The limited partner can access the liquidity it needs, and the secondary buyer can invest in a highly diversified pool of mature private assets, typically at a discount on behalf of its investors.

00:01:55 – 00:02:24

In a GP led transaction, the general partner or fund manager initiates the sales of one or more portfolio companies in its fund. This typically occurs when a GP believes one or more of its investments need more time to grow and maximize their return potential. The assets are moved into a new fund, typically referred to as a continuation vehicle, and provides secondary buyers the opportunity to access a smaller pool of high conviction assets at an attractive price.

00:02:25 – 00:02:50

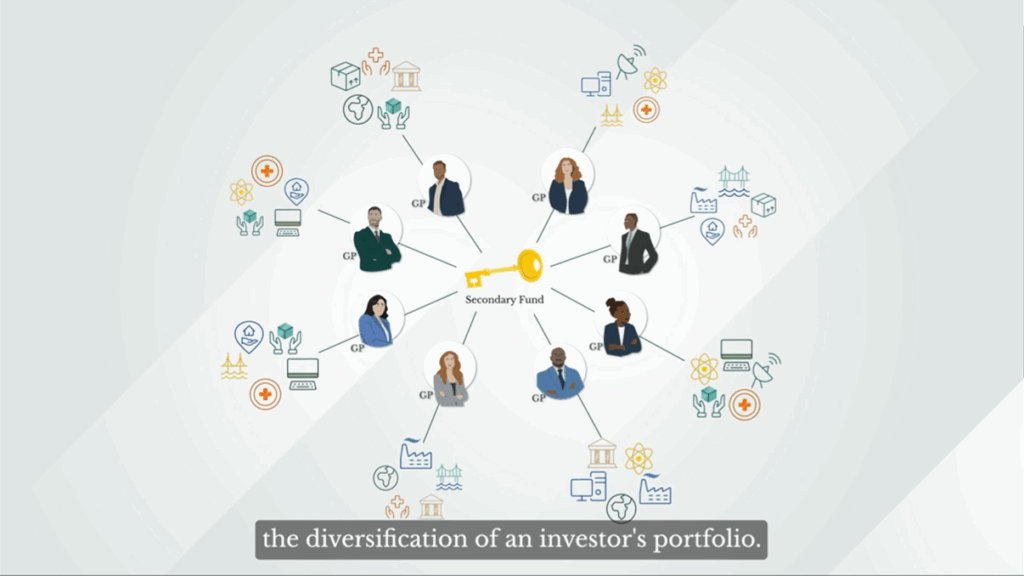

Investing in secondaries offers a unique opportunity to access mature assets or portfolios, often at compelling prices. These investments frequently include stakes in hundreds of underlying assets, creating instant portfolio diversification. This level of diversification helps spread risk across industries, geographies, and vintage years, and may enhance overall portfolio stability.

00:02:50 – 00:03:03

Combined with the potential for attractive pricing, secondary investments often deliver a strong risk adjusted return profile compared to other private market strategies. It’s a smart approach to private market investing.

00:03:04 – 00:03:29

Secondaries play a vital role in the private market ecosystem. For sellers, it offers a way to navigate and adapt to changing financial needs and market conditions. For buyers, it provides the opportunity to invest in a mature, highly diversified pool of well vetted private assets with the potential for strong returns, making it a key component of a well-balanced investment portfolio.

00:03:30 – 00:03:50

However, successful investing in this space requires specialized expertise. A skilled manager evaluates portfolios, mitigates risks, and structures deals that deliver value. That’s why partnering with an experienced manager who can confidently guide you through the intricacies of this burgeoning market is essential.