Popular terms

Browse categories

A

Accredited Investor

An individual or business that meets specific financial criteria set by regulators, allowing them to invest in private markets. Typically, this means having a net worth of $1 million excluding equity in a primary home or $200,000 in individual income or $300,000 in income with a spouse.

Act funds (1940 act)

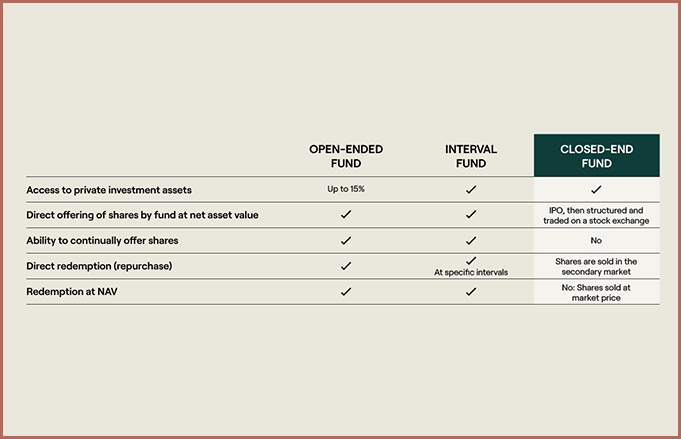

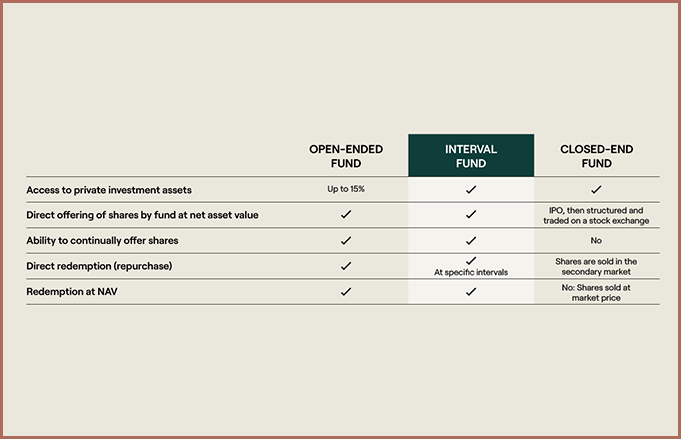

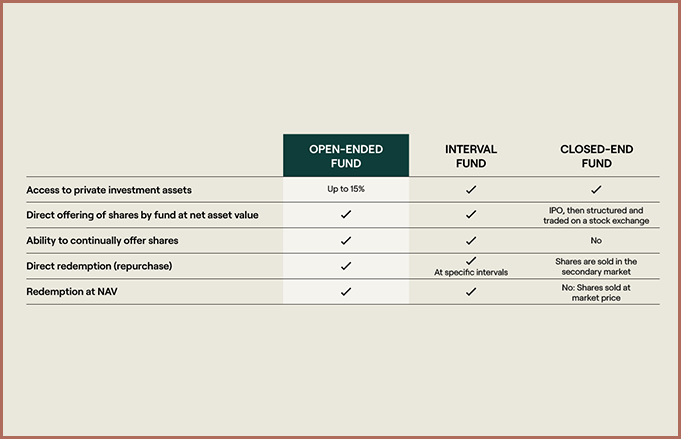

Investment funds regulated under the Investment Company Act of 1940, designed to offer more oversight, transparency, and investor protections. These funds include mutual funds, closed-end funds, interval funds, and tender offer funds.

AIF – Alternative Investment Fund

A fund that invests in assets beyond traditional stocks and bonds, such as private equity, private credit, hedge funds, and real estate.

Alternative Investments

Investments that are not traditional stocks, bonds, or cash. These include private equity, private credit, secondaries, hedge funds, real estate, and infrastructure, often offering diversification and unique return opportunities.

Anchor Investor

A large, early investor in a fund who provides credibility and attracts other investors. Their involvement signals confidence in the fund’s potential.

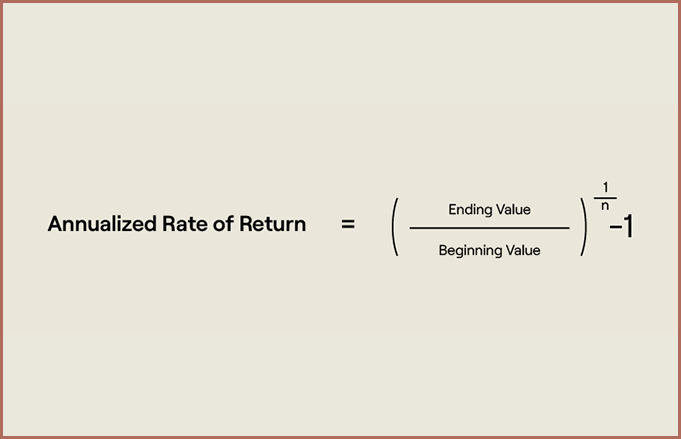

Annualised Return

The average return of an investment per year, adjusted to reflect what it would be if the investment had grown at a steady rate. Helps compare returns over different time periods.

Appraised Value

The estimated market value of an asset, determined by a professional assessment, often used in real estate or private business valuations.

Arranger

A financial institution, typically an investment bank, that structures and organizes a loan or bond issuance. The arranger helps bring together investors and borrowers, setting the terms and distributing the debt.

Asset Class

A group of similar investments that behave in a comparable way in the market. Examples include stocks, bonds, real estate, and private equity.

Asset-Backed Finance

A type of lending where loans are secured by specific assets, such as real estate, equipment, or receivables, which serve as collateral in case of default.

AUM – Assets Under Management

The total value of investments managed by a firm or fund.

B

Basis Point (bps)

A unit of measurement for interest rates or investment returns. One basis point equals 0.01% (100 basis points = 1%).

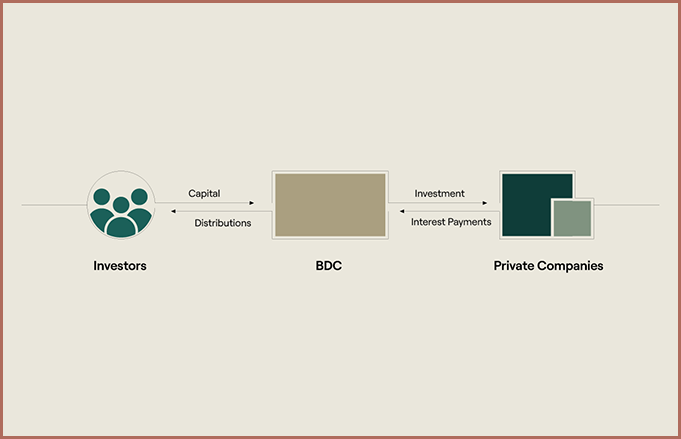

BDC – Business Development Company

A type of investment company that provides capital to small and mid-sized businesses, often through loans or equity investments.

Blind Pool

A private investment fund where investors commit capital without knowing the specific assets the fund will invest in.

Bookrunner

The lead bank or financial institution responsible for managing the issuance of a loan or bond, coordinating investors, and ensuring the deal is successfully executed.

Bridge Loan

A short-term loan used to provide immediate financing until permanent financing is secured or an existing obligation is met. Often used in real estate or business acquisitions.

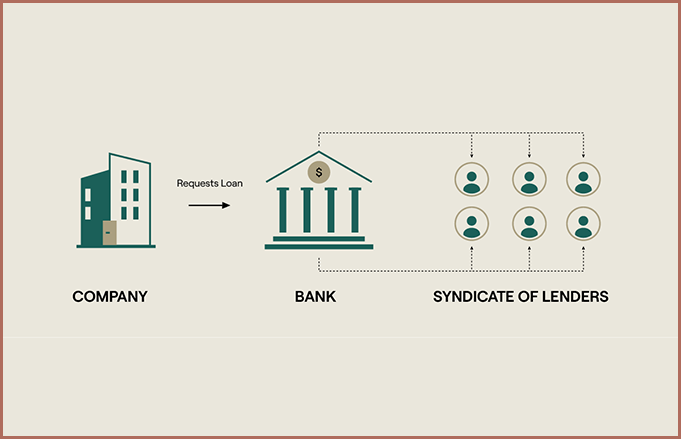

Broadly Syndicated Loans

Refers to loans that are issued by a borrower and then sold to a large group of institutional investors, such as banks, hedge funds, or pension funds.

Brownfield

A previously developed site, often industrial or commercial, that may require environmental remediation before redevelopment. These sites are typically less risky than undeveloped land (greenfield) due to existing infrastructure.

Buyout

The purchase of a company or a controlling stake, often by private equity firms, to improve operations, restructure, or sell at a profit later.

C

CAGR – Compound Annual Growth Rate

A measure of an investment’s average annual growth over a set period, assuming profits are reinvested each year.

Capital Call

When a private fund requests a portion of the money that investors have committed to the fund. Investors provide capital as needed rather than all at once.

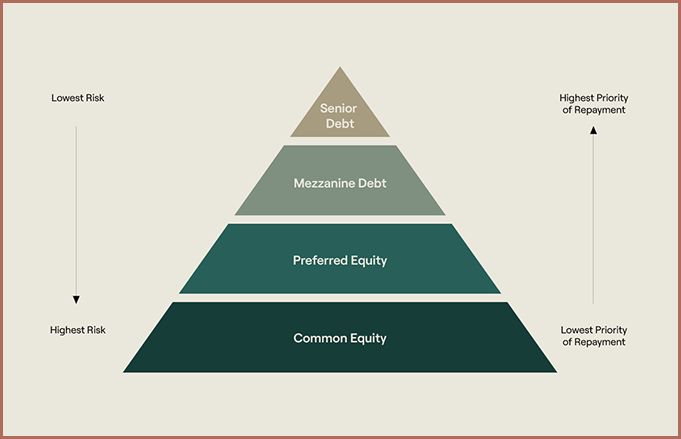

Capital Structure

How a company or fund is financed, including a mix of debt (borrowed money) and equity (investor capital). A balanced capital structure can impact risk and returns.

Capitalisation Rate (Cap Rate)

A real estate valuation metric calculated as Net Operating Income (NOI) ÷ Property Value. It indicates the expected return on an investment property and helps compare different properties’ profitability.

Carried Interest (Carry)

A share of a fund’s profits that goes to the fund manager (General Partner) as compensation, typically after meeting a minimum return threshold for investors.

Cash Drag

When a fund holds too much cash instead of investing it, which can lower overall returns because cash typically earns little to no interest.

Cash Flow

The movement of money in and out of an investment or business. Positive cash flow means more money is coming in than going out, while negative cash flow is the opposite.

Cash on Cash Return

A measure of an investor’s cash income relative to the cash invested, often used in real estate. Formula: Annual Cash Flow ÷ Initial Investment = Cash on Cash Return

Catch-Up

A provision in fund agreements that allows fund managers to receive a larger share of profits after investors have earned a certain return. Ensures managers get their full carried interest.

Clawback

A clause requiring fund managers to return previously earned profits if later investments perform poorly, ensuring investors receive their fair share of overall returns.

CLO – Collateralised Loan Obligation

A financial product that pools loans, often made to companies, and sells them to investors in different risk tiers.

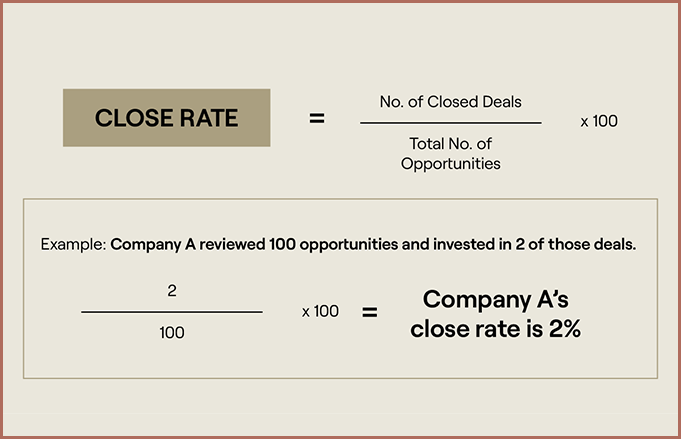

Close Rate

The percentage of investment opportunities or deals that are successfully completed relative to those considered.

Closed-End Fund

A type of investment fund with a fixed amount of capital that is raised once and then invested over a set period. Investors cannot withdraw money until the fund ends.

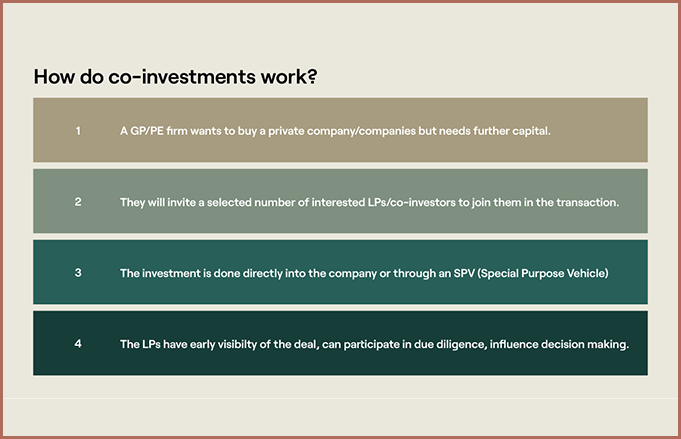

Co-Investment

When an investor participates in a specific deal alongside a private equity or venture capital fund, often with lower fees than investing in the main fund.

Commercial Real Estate

Real estate used for business purposes, such as office buildings, retail centres, hotels, and industrial properties.

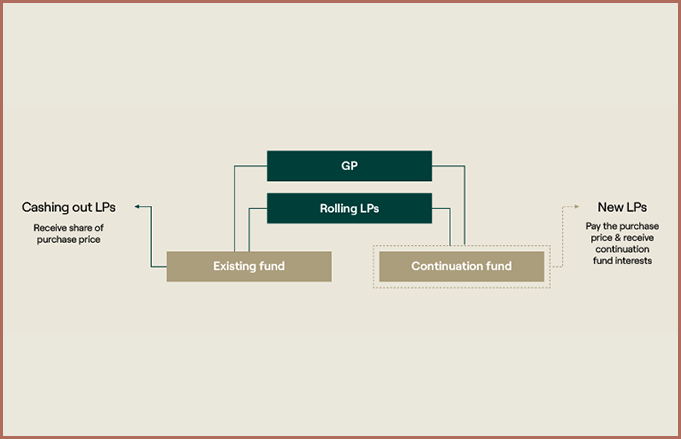

Continuation Fund

A new fund created to hold and manage existing investments beyond the original fund’s term, often giving investors the choice to cash out or stay invested.

Core Plus Plus Real Estate

A real estate strategy involving slightly higher risk than core investments. Core plus properties may require minor improvements, management efficiencies, or repositioning to enhance returns.

Core Real Estate

A low-risk real estate investment strategy focused on high-quality, fully leased properties in prime locations with stable income and minimal need for improvements.

Correlation

A measure of how two investments move in relation to each other. If they move together, they are highly correlated; if they move in opposite directions, they are negatively correlated.

Covenant

A requirement or restriction placed on a borrower by a lender to ensure financial discipline. Covenants can be financial (e.g., maintaining a certain debt-to-income ratio) or operational (e.g., restrictions on additional borrowing).

Credit Risk

The risk that a borrower will not repay a loan, which can impact the value of debt investments like bonds or private credit.

Custodian

A financial institution that holds and safeguards assets for investors, ensuring they are secure and properly managed.

D

Deal Velocity

The speed at which investment deals are completed within a given period, often indicating how active a market or fund is.

Default

When a borrower fails to meet their debt obligations, such as missing interest or principal payments, potentially leading to legal action or asset seizure.

Direct Lending

A form of private credit where non-bank lenders, such as private equity or credit funds, provide loans directly to companies rather than through public debt markets.

Distressed Debt

Debt issued by companies experiencing financial difficulty, often trading at a discount due to a high risk of default. Investors may purchase distressed debt with the aim of restructuring and recovering value.

Distribution Rate

The percentage of an investment fund’s total value that is paid out to investors as income or profit over a specific period.

Diversification

A strategy that spreads investments across different assets to reduce risk. The idea is that if one investment performs poorly, others may perform well and balance the impact.

Downside Protection

Measures taken to limit potential losses in an investment, such as hedging strategies, structured products, or capital preservation techniques.

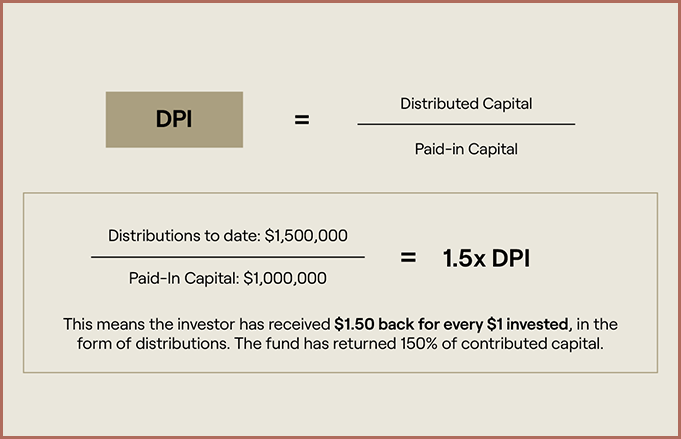

DPI – Distributed to Paid-In Capital

A measure of how much cash a fund has returned to investors compared to the capital they originally invested.

Drawdown Fund

A type of investment fund where investors commit capital upfront but only provide money when the fund calls (draws down) the capital over time for investments.

Dry Powder

Cash or available capital that a fund has set aside to invest but has not yet deployed.

Due Diligence

The research and analysis conducted before making an investment to assess its risks, financials, and overall viability.

E

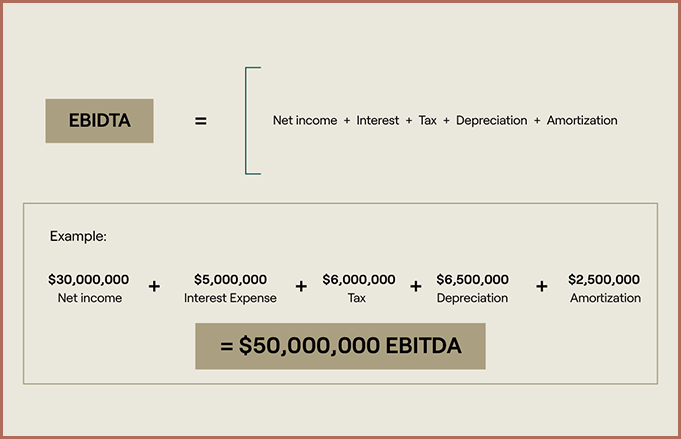

EBITDA – Earnings Before Interest, Taxes, Depreciation, and Amortisation

A measure of a company’s profitability that excludes expenses related to financing, taxes, and accounting adjustments.

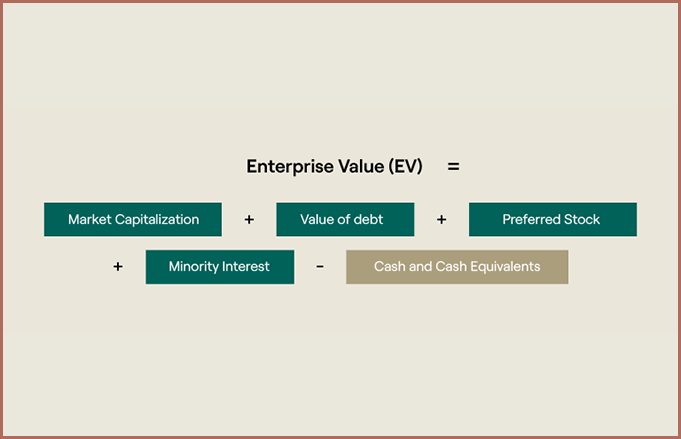

Enterprise Value (EV)

A company’s total value, including its market capitalization, debt, and cash. It represents the full cost to acquire the business.

Evergreen Fund

A type of investment fund with no fixed end date, allowing continuous investment and reinvestment rather than winding down after a set period.

F

Fee Holiday

A period during which investors do not have to pay management fees, often used to attract early investors.

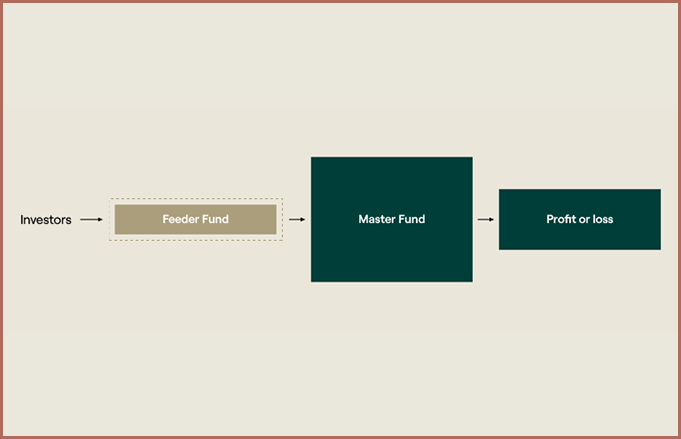

Feeder Fund

A smaller fund that pools investor capital and invests it into a larger, master fund, providing investors indirect access to opportunities they might not otherwise reach.

First Lien Loan

A loan that has the highest priority in repayment, meaning the lender gets paid first in the event of default or liquidation.

Fixed Rate

A loan or bond with an interest rate that remains constant throughout the life of the debt, providing predictable payments for the borrower.

Floating Rate

A loan or bond with an interest rate that adjusts periodically based on a benchmark rate, such as SOFR (Secured Overnight Financing Rate), reducing interest rate risk for lenders.

FMV – Fair Market Value

The estimated price an asset would sell for in an open market between a willing buyer and seller.

FoF – Fund of Funds

A fund that invests in multiple other funds rather than directly in individual companies or assets.

Form 10-K

An annual report that public companies must file with the SEC, containing detailed financial statements and business performance.

Form 10-Q

A quarterly report that public companies must file with the SEC, providing interim financial updates between annual reports.

Fund Administrator

A third-party firm that handles a fund’s operational tasks, including accounting, reporting, and compliance.

G

GP – General Partner

The entity or individual responsible for managing an investment fund and making investment decisions.

GP Commitment

The amount of money the General Partner (GP) invests in their own fund, showing alignment with investor interests.

GP-Led Transaction

A process where a fund’s General Partner (GP) initiates the sale or restructuring of an existing fund's assets, often through a continuation fund, to provide liquidity options to investors.

Greenfield

An undeveloped piece of land where new construction takes place. These projects often involve greater initial costs and risks than brownfield developments due to the need for infrastructure and zoning approvals.

Growth Capital

Funding provided to established companies looking to expand, enter new markets, or acquire other businesses. Unlike venture capital, it focuses on scaling existing operations rather than funding start-ups

H

Hard Cap

The maximum amount of capital a fund is allowed to raise, as set in its offering documents.

Hard Lock-Up

A period when investors cannot withdraw or sell their investment, ensuring stability for the fund.

High Net Worth (HNW)

An individual with significant financial assets, often qualifying them for exclusive investment opportunities.

Hurdle Rate

The minimum return a fund must achieve before it can collect performance fees, ensuring investors receive a certain level of returns first.

I

Infrastructure

Physical assets that provide essential services, such as roads, bridges, airports, utilities, and communication networks. Infrastructure investments often offer long-term, stable returns.

Institutional Investor

Large organizations, such as pension funds, endowments, or insurance companies, that invest substantial amounts of capital in financial markets.

Interval Fund

A type of investment fund that allows periodic (but not daily) redemptions, providing some liquidity while still investing in private or illiquid assets.

Investment Period

The timeframe during which a fund actively makes new investments before focusing on managing and exiting them.

IPO – Initial Public Offering

The process of a private company selling shares to the public for the first time.

IRR – Internal Rate of Return

A metric used to measure the profitability of an investment over time, expressed as an annual percentage.

J

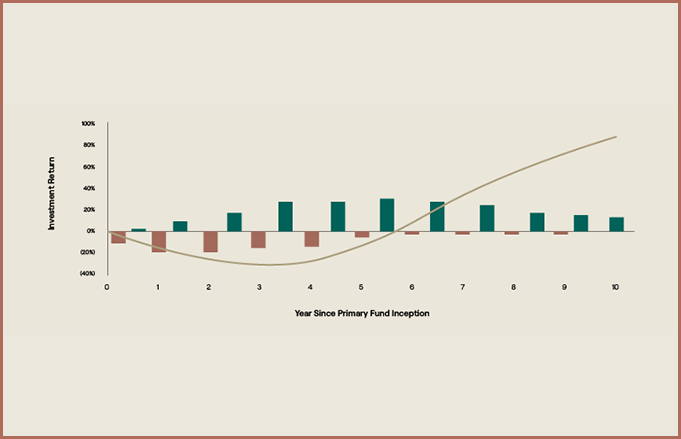

J-Curve

A concept in private equity where returns are often negative in the early years due to fees and investments before improving as exits and profits materialize. The performance chart typically resembles the letter "J.“

Joint Venture (JV)

A business arrangement where two or more parties collaborate to invest in or manage an asset, sharing risks and profits.

L

LBO – Leveraged Buyout

The purchase of a company using borrowed money, with the company’s assets often used as collateral.

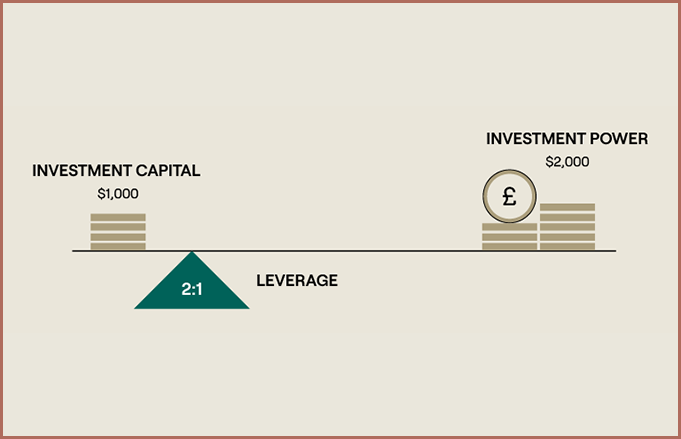

Leverage

Using borrowed money to increase the size of an investment, which can amplify both gains and losses.

Limited Partnership (LP)

A legal structure for investment funds where the General Partner (GP) manages the fund, and investors (Limited Partners) provide capital with limited liability.

Liquidation Stage

The phase when a fund sells its investments and returns capital to investors, typically toward the end of the fund’s life.

Liquidity

How easily an asset or investment can be converted into cash without significantly affecting its price.

Loss Rate

The percentage of investments in a fund that fail or lose money.

LP – Limited Partner

An investor in a private investment fund who provides capital but does not manage the fund.

LP-Led Transaction

A secondary market transaction where Limited Partners (LPs) sell their stakes in a private equity fund to another investor, usually to gain liquidity before the fund’s natural exit.

LPA – Limited Partnership Agreement

The legal document outlining the terms between a fund’s general partner and its investors.

M

Management Fee

A fee paid to fund managers for overseeing investments, usually a percentage of assets under management (AUM).

Mergers & Acquisitions (M&A)

The process of companies merging together (merger) or one company purchasing another (acquisition) to grow or gain market advantages.

Mezzanine Debt

A hybrid form of financing that sits between senior debt and equity. It typically carries higher interest rates and may include equity-like features, such as warrants or conversion options.

Middle Market

Companies that are larger than small businesses but smaller than large, publicly traded corporations, often the focus of private equity investments.

Mixed-Use Real Estate

A real estate development that combines multiple property types, such as residential, commercial, office, and retail, within a single project or area to create a vibrant, integrated community.

MOIC – Multiple on Invested Capital

A measure of how much an investment has grown, calculated as total value divided by the original investment.

Multi-Family Real Estate

A residential property with multiple housing units, such as apartment buildings or town homes, designed to accommodate multiple tenants or families.

N

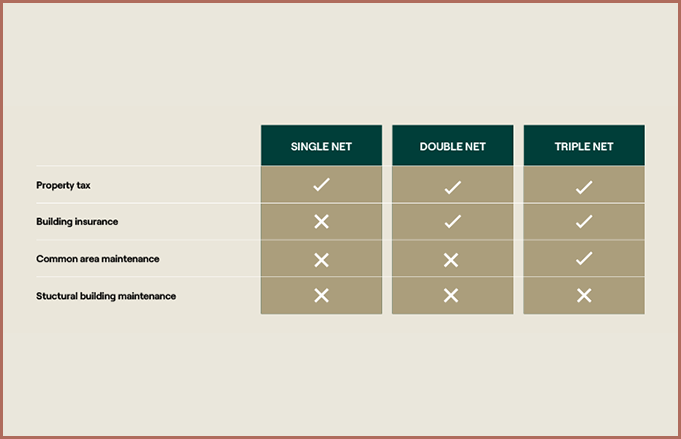

Net Lease

A lease agreement where the tenant is responsible for property expenses such as taxes, insurance, and maintenance, in addition to rent. Common types include single-net (N), double-net (NN), and triple-net (NNN) leases.

NNN – Triple Net Lease

A lease agreement where the tenant is responsible for property taxes, insurance, and maintenance, in addition to rent.

NOI – Net Operating Income

A measure of a property’s profitability, calculated as income from rent minus operating expenses.

Non-Accrual

A loan status indicating that interest payments are no longer being recognized as income by the lender because the borrower has stopped making scheduled payments.

O

Offering Documents

Legal documents that outline the terms, risks, and details of an investment fund, helping investors make informed decisions.

Open-Ended Fund

A fund that continuously accepts new investor capital and allows redemptions, unlike closed-end funds that have a fixed capital pool.

Opportunistic Debt

A high-risk, high-return investment strategy that targets mispriced or distressed credit situations, such as buying discounted loans or financing turnarounds.

Origination

The process of identifying, evaluating, and structuring new investment opportunities.

P

PIK – Payment-in-Kind Interest

Instead of paying interest in cash, the borrower adds the interest to the loan balance—essentially paying with more debt. This means the investor doesn’t get regular cash payments, but the amount owed grows over time. PIK interest is common in private credit deals where the borrower wants to conserve cash early on and repay more later.

PME – Public Market Equivalent

A method of comparing private market investment performance against a public market index.

Portfolio Company

A business that a private equity or venture capital fund has invested in as part of its portfolio.

PPM – Private Placement Memorandum

A document that provides investors with detailed information about a private investment offering.

Primary Fund

A private investment fund that makes direct investments in assets, as opposed to a secondary fund that buys existing investments from other investors.

Private Credit

Loans and debt investments made by non-bank institutions, such as private equity firms or asset managers, to businesses that do not access traditional public debt markets.

Private Equity

A form of investment where funds or firms invest directly in private companies, aiming to improve operations and generate returns through growth or buyout strategies.

Private Real Estate

Investing in properties such as apartment buildings, office towers, warehouses, or shopping centers, through private deals that are not traded on public stock exchanges. These investments are typically made through private funds or partnerships. Private real estate can offer steady income (through rent), potential appreciation, and diversification, but it’s usually less liquid than public real estate investments like REITs.

Private Wealth

Investment management for high-net-worth individuals, families, and small institutions, often involving tailored strategies and alternative investments.

Prospectus

A legal document providing details about an investment opportunity, including risks, financials, and fund strategy.

Public Markets

Markets where stocks, bonds, and other securities are bought and sold openly, such as the New York Stock Exchange (NYSE) or Nasdaq.

Q

Qualified Client

An investor who meets certain wealth or experience thresholds set by regulators, allowing them to invest in specific private funds with higher risks. Typically, they must have at least $2 million in net worth (excluding their primary residence) or $1 million in assets under management with an advisor.

Qualified Purchaser

A more exclusive investor classification than a Qualified Client, typically requiring at least $5 million in investments. This status allows access to private funds that are not registered with the SEC.

R

Real Assets

Tangible assets like real estate, infrastructure, and commodities that have intrinsic value and can act as an inflation hedge.

Recapitalisation

A financial strategy where a company changes its debt and equity mix, often to raise capital, improve stability, or allow investors to exit.

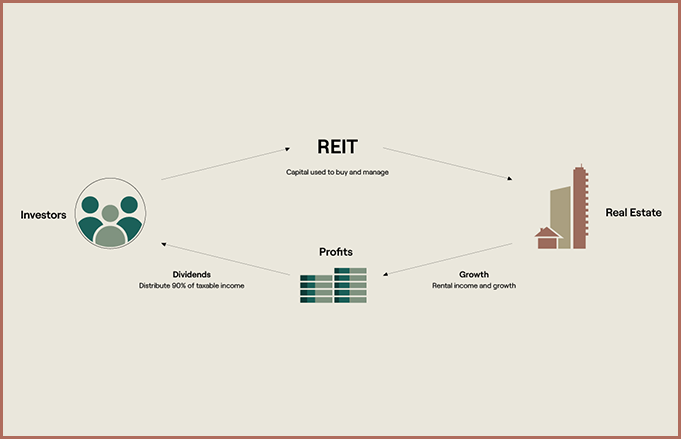

REIT – Real Estate Investment Trust

A company that owns or finances real estate properties and distributes income to investors.

Return of Capital

When an investor receives back their original investment amount, separate from any profits or earnings.

RIA – Registered Investment Advisor

A firm or individual who provides investment advice and is registered with financial regulators.

RIC – Registered Investment Company

A pooled investment vehicle, such as a mutual fund, that must meet specific regulatory requirements.

Risk-Adjusted Return

A measure of investment return that considers the level of risk taken to achieve it, helping investors compare different investments more effectively

RVPI – Residual Value to Paid-In Capital

A measure of how much value remains in a fund’s portfolio relative to the capital invested by investors.

S

SEC – Securities and Exchange Commission

The U.S. government agency that regulates financial markets and protects investors.

Second Lien Loan

A loan that ranks below a first-lien loan in repayment priority, meaning it is paid only after senior debts are satisfied in a default scenario.

Secondaries

Investments in existing private market fund stakes or assets, allowing investors to buy or sell positions in funds before they fully mature.

Seed Investor

An early-stage investor who provides the initial funding for a startup or fund, often receiving favorable terms in exchange for taking on higher risk.

Senior Secured Loan

A loan that is backed by specific collateral and has priority over other debts in case of bankruptcy, reducing the lender’s risk.

SICAV – Société d’Investissement à Capital Variable

A European investment fund structure that allows investors to buy and sell shares at the fund’s net asset value.

SMA – Separately Managed Account

A customised investment account managed for a single investor, rather than pooled with others

SOFR – Secured Overnight Financing Rate

A benchmark interest rate based on transactions in the U.S. Treasury repurchase market, often used for loans.

Soft Lock-Up

A period where investors are discouraged from withdrawing their investment, but they can still do so with a penalty or notice period.

SPV – Special Purpose Vehicle

A legal entity created for a specific financial purpose, such as holding assets or isolating risk.

Standard Deviation

A statistical measure that shows how much an investment’s returns vary over time. A higher standard deviation means higher volatility.

Subscription Agreement

A legal contract between an investor and a private fund, detailing investment terms, commitments, and investor obligations.

Suitability

The process of determining whether an investment is appropriate for an investor based on their risk tolerance, financial situation, and investment goals.

Supplement to Prospectus

An update or amendment to a fund’s original prospectus, providing additional or revised information for investors.

T

Take-Private

When a publicly traded company is bought out and converted into a privately held entity, often by private equity firms.

Tender Offer

A public proposal by an investor or company to buy shares from existing shareholders, usually at a premium price to gain control.

TVPI – Total Value to Paid-In Capital

A measure of a fund’s total performance, combining both realized and unrealized returns relative to the capital invested.

U

Unitranche Loan

A single loan structure that combines senior and subordinated debt into one facility, simplifying financing for borrowers while offering blended risk-return profiles for lenders.

Unsecured Loan (Subordinated Debt)

A loan that is not backed by collateral, meaning the borrower does not pledge assets (such as property or equipment) to secure the loan. Instead, approval is based on the borrower’s creditworthiness, income, and financial history.

V

Value-Add Real Estate

A real estate investment strategy focused on properties with untapped potential. These properties require renovations, operational improvements, or lease-up strategies to increase their value and rental income.

Venture Capital

A subset of private equity that focuses on investing in early-stage, high-growth startups with the potential for significant returns. These investments typically involve higher risk.

Vintage Year

The year a private market fund begins making investments, used as a benchmark to compare performance across different funds and economic cycles.

W

Write Down

A reduction in the reported value of an asset, typically due to market conditions or underperformance.

Y

Yield

The income an investment generates, expressed as a percentage of its cost or market value. Common in bonds and dividend-paying stocks.