et strategies and a key driver of this outperformance is its limited exposure to blind pool risk.

00:00:15 – 00:00:42

Blind pool risk occurs when investors commit to a primary private equity fund before it’s made any investments. In other words, it’s like trying to pick the winner of a race before it’s even started. For example, when a private equity general partner or GP starts a fund with no specific investments in place, it is unknown if they will invest wisely and manage risks effectively.

00:00:42 – 00:01:07

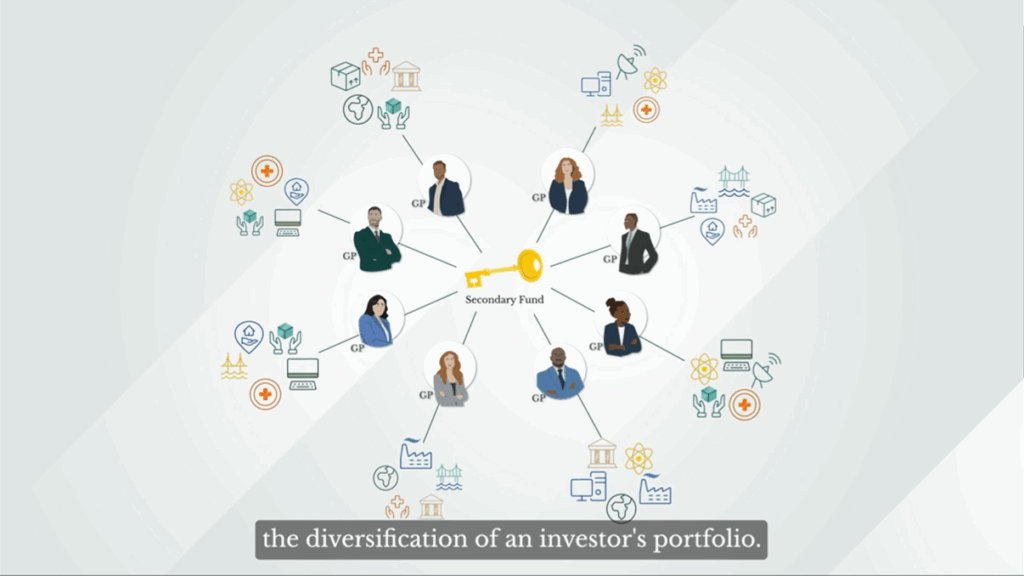

Secondaries investors, however, are uniquely positioned to avoid that blind pool risk. By acquiring exposure in funds, which are more mature and largely fully invested, secondaries buyers can analyse assets in the portfolio and assess their attractiveness prior to making an investment. This is like picking the winner halfway through a race, as you can see who’s performing well and who’s falling behind.

00:01:08 – 00:01:29

Secondaries investors can therefore assess risk with more data than a primary fund investor and price transactions according to that risk, often avoiding an investment altogether. This insight enables secondaries investors to access the potential returns associated with a primary fund investment, but with a higher degree of downside protection.

00:01:30 – 00:01:44

As a result, in the twenty year period between 2004 and 2023, only one percent of secondary funds experienced a loss versus a significantly higher proportion of other private market strategies.

00:01:45 – 00:01:56

Investing in private markets can be complex, and it is not without risk. Partnering with an established manager with a proven ability to navigate various market dynamics is essential.